Delving into the realm of homeowners insurance quotes, this introductory paragraph aims to grab the reader's attention and provide a sneak peek into the comprehensive details that lie ahead.

Following this, a detailed explanation of the components included in a homeowners insurance quote will be unveiled, shedding light on what is covered and what is excluded.

What Does a Homeowners Insurance Quote Include?

When you receive a homeowners insurance quote, it typically includes several key components that Artikel the coverage and costs associated with the policy. Understanding what a homeowners insurance quote includes is crucial for making informed decisions about protecting your home and assets.

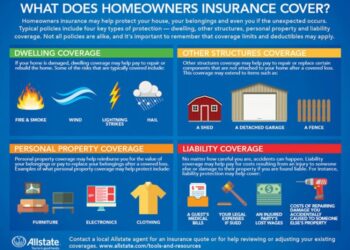

Coverage Types

- Dwelling Coverage: This part of the quote protects the physical structure of your home in case of damage from covered perils like fire, wind, or vandalism.

- Personal Property Coverage: It includes coverage for your belongings inside the home, such as furniture, appliances, and electronics.

- Liability Coverage: This coverage protects you in case someone is injured on your property and sues you for damages.

Additional Coverage Options

- Additional Living Expenses: If your home becomes uninhabitable due to a covered loss, this coverage helps with temporary living expenses.

- Medical Payments: Covers medical expenses for guests injured on your property, regardless of who is at fault.

- Flood Insurance: Typically not included in a standard homeowners policy, but can be added as additional coverage if you live in a flood-prone area.

Deductibles and Limits

- Deductibles: This is the amount you have to pay out of pocket before your insurance kicks in. Higher deductibles usually result in lower premiums.

- Limits: These are the maximum amounts your insurance company will pay for covered losses. It's important to understand these limits to ensure you have adequate coverage.

What Does a Homeowners Insurance Quote Exclude?

When obtaining a homeowners insurance quote, it is crucial to understand what is not covered under a standard policy. This helps homeowners make informed decisions and consider additional coverage options to protect their property adequately.Exclusions from a homeowners insurance quote typically include:

Common Exclusions from a Standard Homeowners Insurance Quote

- Earth movement (such as earthquakes, landslides, and sinkholes)

- Flood damage

- Damage from pests (such as termites or rodents)

- Wear and tear

- Neglect or lack of maintenance

Examples of Items or Events Not Covered

- Damage caused by a flood or earthquake

- Mold growth resulting from poor maintenance

- Infestations by pests like termites

- Losses due to normal wear and tear

Optional Coverage that May Need to be Purchased Separately

- Flood insurance

- Earthquake insurance

- Mold coverage

- Personal property coverage for high-value items

How Policy Endorsements Can Help Address Exclusions

Policy endorsements, also known as riders or floaters, can be added to a homeowners insurance policy to provide additional coverage for specific items or events that are typically excluded. For example, a jewelry endorsement can offer coverage for valuable items like engagement rings that may not be fully covered under a standard policy.

It is essential for homeowners to review their policy endorsements carefully and consider adding them to address any exclusions that may leave their property vulnerable to financial loss.

Factors Influencing Homeowners Insurance Quotes

When it comes to determining the cost of homeowners insurance, there are several factors that can influence the quotes provided by insurance companies. These factors can vary depending on the individual circumstances of the homeowner and the property being insured.

Understanding these factors can help homeowners make informed decisions when shopping for insurance coverage.

Location

The location of your home plays a significant role in determining the cost of homeowners insurance. Homes located in areas prone to natural disasters such as hurricanes, earthquakes, or floods are considered higher risk and may result in higher premiums.

Additionally, the proximity to fire stations, crime rates, and the availability of local services can also impact insurance costs.

Home Value and Construction Materials

The value of your home and the materials used in its construction can also affect insurance quotes. Higher valued homes typically require more coverage, leading to higher premiums. Similarly, homes constructed with more durable materials that are less prone to damage may result in lower insurance costs compared to homes made with less sturdy materials.

Claims History and Credit Score

A homeowner's claims history and credit score are important factors that insurance companies consider when providing quotes. A history of multiple claims or poor credit can signal higher risk to insurers, leading to increased premiums. On the other hand, homeowners with a clean claims record and good credit may be eligible for lower insurance rates.

Tips for Lowering Insurance Premiums

- Consider bundling your homeowners insurance with other policies such as auto or life insurance to receive a multi-policy discount.

- Increasing your deductible can lower your premium, but make sure you can afford the out-of-pocket expenses in case of a claim.

- Improving home security by installing alarms, smoke detectors, and deadbolts can reduce the risk of theft or damage, potentially lowering insurance costs.

- Maintaining a good credit score and staying claims-free can also help lower insurance premiums over time.

Understanding Policy Details in a Homeowners Insurance Quote

When reviewing a homeowners insurance quote, it is crucial to pay attention to the policy details as they can significantly impact the coverage you receive in case of an unfortunate event. Understanding the fine print and specific terms Artikeld in the quote is essential to ensure you have adequate protection for your home.

Coverage Limits and Sub-limits

Homeowners insurance policies often come with coverage limits and sub-limits that specify the maximum amount the insurance company will pay for certain types of losses. It is important to understand these limits to ensure you have sufficient coverage.

- For example, a policy may have a coverage limit of $300,000 for the dwelling structure. If your home incurs damages exceeding this amount, you would be responsible for the additional costs unless you have purchased additional coverage.

- Sub-limits may apply to specific items such as jewelry, electronics, or collectibles. Understanding these sub-limits can help you determine if you need to purchase additional coverage or separate riders to adequately protect your valuable possessions.

Special Terms and Conditions

Homeowners insurance quotes may include special terms and conditions that Artikel specific requirements or exceptions to coverage. It is essential to carefully review these terms to understand any limitations or obligations you have as a policyholder.

For example, some policies may have exclusions for certain types of damage, such as floods or earthquakes. If your home is located in an area prone to these risks, you may need to purchase additional coverage or a separate policy to protect against these specific perils.

Impact of Policy Details on Coverage

The policy details in a homeowners insurance quote can have a significant impact on the coverage you receive. Failure to understand these details could leave you vulnerable to financial losses in the event of a claim.

- For instance, if your policy has a high deductible that you were not aware of, you may be responsible for a substantial portion of the repair costs out of pocket before the insurance coverage kicks in.

- Additionally, not having adequate coverage for certain perils or possessions could result in you having to bear the full cost of repairs or replacements in the event of a covered loss.

Final Review

Wrapping up our discussion on What Does a Homeowners Insurance Quote Include and Exclude?, this concluding paragraph encapsulates the key points discussed and leaves readers with a lasting impression of the topic.

FAQ Overview

What are some common exclusions in a homeowners insurance quote?

Common exclusions may include earthquakes, floods, and certain types of personal property. It's important to review the policy carefully to understand what is not covered.

How can homeowners potentially lower their insurance premiums?

Homeowners can explore options like raising deductibles, bundling policies, improving home security, and maintaining a good credit score to potentially lower their insurance premiums.

What additional coverage options might be included in a homeowners insurance quote?

Additional coverage options could include coverage for identity theft, sewer backup, or scheduled personal property like jewelry. These are usually available as add-ons to the standard policy.