Kicking off with Top Factors That Affect Your Homeowners Insurance Quote, this opening paragraph is designed to captivate and engage the readers, setting the tone casual formal language style that unfolds with each word.

The content of the second paragraph that provides descriptive and clear information about the topic

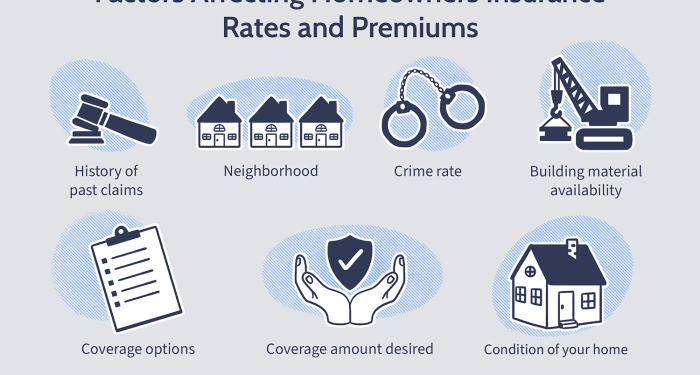

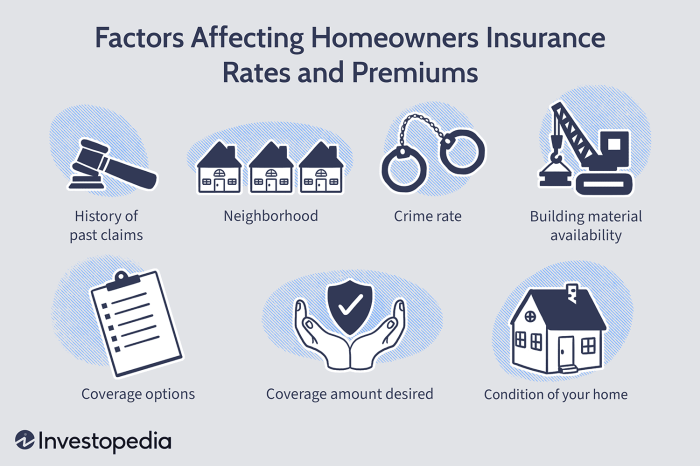

Factors Impacting Homeowners Insurance Quote

When it comes to determining your homeowners insurance quote, several factors play a significant role in influencing the cost. Understanding these factors can help you make informed decisions when selecting a policy that suits your needs and budget.

Location of the Home

The location of your home is a crucial factor that insurers consider when calculating your insurance premium. Homes located in areas prone to natural disasters such as hurricanes, earthquakes, or floods are considered high-risk, resulting in higher insurance rates. Additionally, the crime rate in your neighborhood can also impact your insurance costs, with higher crime areas typically having higher premiums.

Age and Condition of the Home

The age and condition of your home are key factors that insurers take into account when determining your insurance quote. Older homes or properties in poor condition are more susceptible to damage and may require higher coverage limits, leading to increased premiums.

Regular maintenance and upgrades can help mitigate these costs.

Size and Rebuilding Cost of the Home

The size and rebuilding cost of your home also play a significant role in determining your insurance premiums. Larger homes or properties with high rebuilding costs will require higher coverage limits, resulting in higher insurance rates. It's essential to accurately assess the replacement value of your home to ensure you have adequate coverage without overpaying for unnecessary protection.

Proximity to Fire Hydrants or Fire Stations

The proximity of your home to fire hydrants or fire stations can impact your insurance rates. Homes located near fire hydrants or within close proximity to fire stations are considered lower risk by insurers, as they have better access to firefighting resources in case of emergencies.

This reduced risk can lead to lower insurance premiums for homeowners in these areas.

Personal Factors That Affect Insurance Quotes

When it comes to determining homeowners insurance quotes, several personal factors play a crucial role. These factors can impact the cost of your insurance premium and the coverage you receive. Let's delve into some key personal factors that can affect your homeowners insurance quote.

Credit Score Impact

Your credit score is a significant factor that insurers consider when calculating your homeowners insurance quote. A higher credit score typically translates to lower insurance premiums. Insurers often view individuals with higher credit scores as less risky to insure, leading to more favorable rates.

Presence of Swimming Pool or Trampoline

Having a swimming pool or trampoline on your property can increase your homeowners insurance premiums. These features are considered liabilities due to the higher risk of accidents or injuries. Insurers may charge higher premiums or require additional liability coverage to protect against potential claims related to these amenities.

Past Insurance Claims History

Your past insurance claims history can impact your current homeowners insurance quote. If you have a history of filing numerous claims, insurers may perceive you as a higher risk and charge higher premiums. On the other hand, a clean claims history can result in lower insurance costs.

Home Security Systems or Upgrades

Installing home security systems or making upgrades to enhance the safety of your home can lead to lower insurance costs. Insurers often offer discounts for homes with security features such as alarms, cameras, or reinforced doors. These measures can reduce the risk of theft or damage, resulting in savings on your homeowners insurance premiums.

Coverage Options and Their Impact

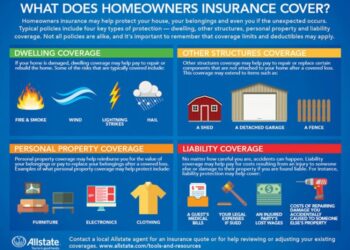

When it comes to homeowners insurance, the coverage options you choose can have a significant impact on your insurance quotes. Understanding how different coverage levels, additional coverages, deductibles, and bundling policies can affect your premiums is essential in making informed decisions.

Impact of Different Coverage Levels

- Basic coverage typically includes protection for your home's structure, personal belongings, liability coverage, and additional living expenses in case of a covered loss.

- Opting for higher coverage limits can increase your premiums, but it provides more financial protection in case of a major disaster or loss.

- Consider your home's value, location, and potential risks when deciding on the appropriate coverage level.

Additional Coverages like Flood or Earthquake Insurance

- Adding additional coverages like flood or earthquake insurance can significantly impact your premiums, especially if you live in a high-risk area.

- These coverages are usually not included in standard homeowners insurance policies, so it's essential to assess your risk exposure and consider adding them if necessary.

- While these additional coverages may increase your premiums, they provide crucial protection against specific risks that are not covered by basic policies.

Impact of Deductibles

- A deductible is the amount you agree to pay out of pocket before your insurance coverage kicks in.

- Choosing a higher deductible typically leads to lower premiums, but it also means you'll have to pay more in case of a claim.

- Consider your financial situation and risk tolerance when deciding on a deductible amount.

Bundling Policies for Discounts

- Bundling policies, such as combining your auto and home insurance with the same provider, can often lead to discounts on your premiums.

- Insurance companies offer discounts to customers who purchase multiple policies from them, making it a cost-effective option for homeowners.

- Be sure to compare bundled policy options and discounts from different insurers to find the best deal for your insurance needs.

External Factors Affecting Insurance Quotes

When it comes to determining homeowners insurance quotes, there are several external factors that can significantly impact the final premium you pay. Understanding these factors is crucial in ensuring you get the most accurate and competitive quote for your home insurance needs.

Insurance Company's Underwriting Guidelines

Insurance companies have specific underwriting guidelines that dictate how they assess risk and determine premiums for homeowners insurance. These guidelines take into account various factors such as the age of your home, its location, construction materials, and more. Deviating from these guidelines can lead to higher premiums.

Local Weather Risks

Local weather risks, such as hurricanes or tornadoes, can have a significant impact on homeowners insurance premiums. Areas prone to natural disasters are considered high-risk by insurance companies, leading to higher premiums to account for the increased likelihood of damage to homes in these areas.

Rising Construction Costs

Rising construction costs can also affect insurance quotes. In the event of a claim, insurance companies may need to cover the cost of rebuilding or repairing your home. As construction costs increase, insurance companies adjust their premiums to reflect the higher costs of materials and labor.

Natural Disasters Frequency

The frequency of natural disasters in a particular area can directly impact homeowners insurance premiums. If an area is prone to frequent disasters such as floods, wildfires, or earthquakes, insurance companies are more likely to charge higher premiums to mitigate the increased risk of damage to homes in that area.

Final Conclusion

The content of the concluding paragraph that provides a summary and last thoughts in an engaging manner

FAQ Overview

How does the location of the home impact insurance quotes?

The location of the home can affect insurance quotes due to varying risks associated with different areas. Urban areas with higher crime rates or prone to natural disasters may have higher premiums.

Does adding flood or earthquake insurance increase premiums?

Adding additional coverage like flood or earthquake insurance can lead to higher premiums, as these are considered high-risk events that require more coverage.

Can past insurance claims history affect current quotes?

Yes, past insurance claims history can impact current quotes as it indicates the likelihood of future claims, which may lead to higher premiums.