Embark on a journey to unravel the intricacies of your homeowners insurance quote. From deciphering coverage details to understanding premiums and costs, this guide will equip you with the knowledge needed to make informed decisions about your insurance coverage.

Understanding Homeowners Insurance Quote

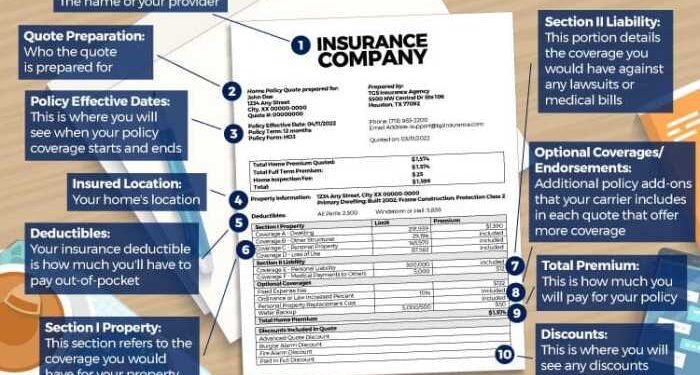

A homeowners insurance quote is an estimate provided by an insurance company that Artikels the coverage options and associated costs for insuring your home and personal property.

Components of a Homeowners Insurance Quote

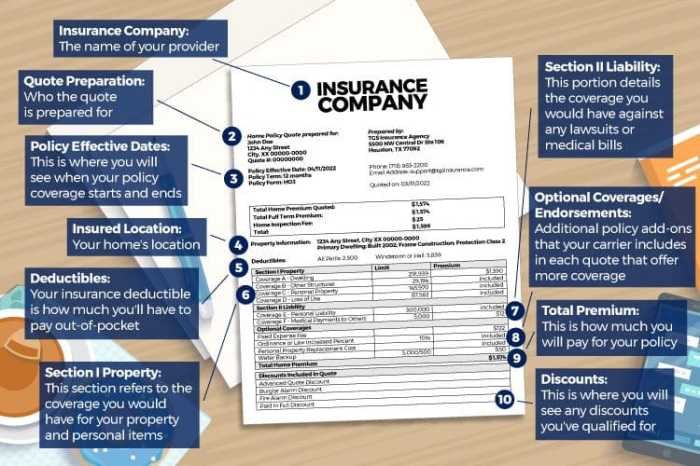

A typical homeowners insurance quote includes the following components:

- Property coverage: This protects your home and other structures on your property from covered perils like fire, theft, and vandalism.

- Personal property coverage: This covers your belongings inside your home, such as furniture, clothing, and electronics.

- Liability coverage: This protects you in case someone is injured on your property and you are found legally responsible.

- Deductible: This is the amount you will have to pay out of pocket before your insurance coverage kicks in.

- Premium: This is the amount you will pay for the insurance policy, usually on a monthly or annual basis.

Importance of Reading and Understanding Your Homeowners Insurance Quote

It is crucial to read and understand your homeowners insurance quote to ensure that you have the right coverage for your needs and that you are not underinsured in case of an emergency or disaster. By reviewing the quote carefully, you can make informed decisions about the level of coverage you need and any additional endorsements or riders that may be necessary to protect your home and assets.

Decoding Coverage Details

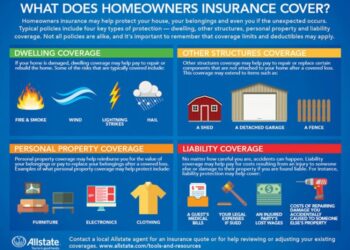

Understanding the different types of coverage mentioned in a homeowners insurance quote is essential to know what protection you are getting for your property. Let's break down the key types of coverage and how they can impact your insurance quote.

Dwelling Coverage

Dwelling coverage is the part of your homeowners insurance policy that helps pay to rebuild or repair the physical structure of your home if it's damaged by a covered peril, such as fire or windstorm. For example, if a tree falls on your house during a storm and causes damage to the roof, dwelling coverage would help cover the cost of repairs.

Personal Property Coverage

Personal property coverage helps protect your belongings inside your home, such as furniture, clothing, and electronics. If your personal belongings are stolen or damaged by a covered peril, like a burglary or fire, this coverage can help replace or repair them.

For instance, if your laptop is stolen during a break-in, personal property coverage would help cover the cost of a new one.

Liability Coverage

Liability coverage protects you if someone is injured on your property or if you accidentally damage someone else's property. If a guest slips and falls on your icy driveway or your child accidentally breaks a neighbor's window, liability coverage can help cover legal expenses, medical bills, and repairs.

Coverage Limits and Deductibles:

Your coverage limits and deductibles can impact your insurance quote significantly. Coverage limits refer to the maximum amount your insurance company will pay for a covered loss, while deductibles are the amount you must pay out of pocket before your insurance kicks in.

Higher coverage limits and lower deductibles typically result in higher insurance premiums, while lower coverage limits and higher deductibles can lower your premiums.

Unraveling Premiums and Costs

When it comes to understanding your homeowners insurance quote, unraveling the premiums and costs is a crucial step. Knowing how these costs are calculated and what factors can influence them will help you make informed decisions about your coverage.

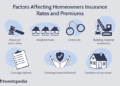

Factors Influencing Premiums

- Your Home's Location: The location of your home plays a significant role in determining your insurance premiums. Homes located in areas prone to natural disasters or high crime rates may have higher premiums.

- Home Value: The value of your home is another important factor. More expensive homes typically have higher insurance costs due to the increased cost of rebuilding or repairing them.

- Credit Score: Your credit score can also impact your insurance costs. Insurers may use your credit score to assess the risk of insuring you, with lower scores potentially leading to higher premiums.

Tips to Lower Insurance Costs

- Review Coverage Limits: Take a close look at the coverage limits in your quote. You may be able to adjust these limits to better suit your needs and potentially lower your premiums.

- Bundle Policies: Consider bundling your homeowners insurance with other policies, such as auto insurance, to receive a discount from the insurer.

- Improve Home Security: Installing security systems or making other home improvements that reduce risk can lead to lower insurance costs.

Reviewing Exclusions and Endorsements

When reviewing your homeowners insurance quote, it is crucial to pay close attention to the exclusions and endorsements listed. Exclusions are specific situations or items that are not covered by your policy, while endorsements are modifications that can be added to enhance or expand your coverage.

Common Exclusions in Homeowners Insurance

Exclusions in homeowners insurance quotes can vary, but some common ones to look out for include:

- Earth movement (such as earthquakes)

- Flood damage

- Intentional damage caused by the policyholder

- Wear and tear or maintenance-related issues

- Damage from pests or mold

Purpose of Endorsements

Endorsements are additional provisions that can be added to your policy to customize or extend your coverage. They can help fill gaps in your standard policy and provide extra protection for specific items or situations. For example, you may need an endorsement for valuable jewelry or high-end electronics that exceed your standard coverage limits.

Importance of Reviewing Exclusions and Endorsements

It is important to carefully review both the exclusions and endorsements in your homeowners insurance quote to ensure you have a clear understanding of what is and isn't covered. By knowing the exclusions, you can take steps to mitigate risks or explore additional coverage options if needed.

Understanding endorsements allows you to tailor your policy to better suit your individual needs and protect your valuable assets effectively.

Last Recap

In conclusion, mastering the art of reading and understanding your homeowners insurance quote is crucial in safeguarding your most valuable asset - your home. Armed with this knowledge, you can navigate the complexities of insurance with confidence and ensure you have the coverage you need.

Expert Answers

What factors can influence the cost of homeowners insurance?

Factors such as location, home value, and credit score can all impact the cost of your homeowners insurance.

Why is it important to pay attention to exclusions and endorsements in the insurance quote?

Exclusions can specify what is not covered, while endorsements can modify your coverage. Understanding these can prevent surprises during claims.

How can I potentially lower my insurance costs based on the information in the quote?

You can explore options like increasing deductibles, bundling policies, or improving home security to potentially lower your insurance costs.