Embark on a journey to discover the legal ways to reduce your homeowners insurance quote. This insightful guide will explore various strategies and tips to help you save on insurance costs while staying compliant with the law.

Delve into the nuances of homeowners insurance and uncover practical methods to lower your premiums without compromising on coverage.

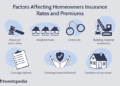

Factors Affecting Homeowners Insurance Quotes

When it comes to determining homeowners insurance quotes, several factors come into play. Understanding these factors can help homeowners make informed decisions to lower their insurance costs.

Location

The location of your home plays a significant role in determining your insurance premium. Homes located in areas prone to natural disasters such as hurricanes, earthquakes, or floods are considered high-risk and may result in higher premiums. To mitigate this factor, homeowners can invest in protective measures such as reinforcing their homes against specific hazards or choosing a less risky location.

Home Value and Replacement Cost

The value of your home and its replacement cost are crucial factors in determining insurance quotes. A higher home value or replacement cost typically results in higher premiums. To lower insurance costs, homeowners can consider renovating their homes to reduce risks, such as upgrading the roofing or electrical systems.

Claims History

Your claims history can impact your insurance rates. If you have a history of filing multiple claims, insurers may perceive you as a higher risk and increase your premiums. To lower insurance quotes, homeowners can avoid filing small claims and only use their insurance for significant losses.

Credit Score

Your credit score can also affect your homeowners insurance quotes. Insurers use credit information to assess the likelihood of you filing a claim. To lower insurance costs, homeowners can work on improving their credit score by paying bills on time and reducing debt.

Deductible Amount

The deductible amount you choose can impact your insurance premium. A higher deductible typically results in a lower premium, but homeowners should ensure they can afford the deductible in case of a claim. By opting for a higher deductible, homeowners can lower their insurance quotes.

Legal Ways to Lower Homeowners Insurance Quotes

When it comes to reducing your homeowners insurance quotes legally, there are several strategies you can implement to potentially lower your costs. Improving home security, maintaining your property, and bundling insurance policies are all effective ways to decrease your insurance premiums.

Improving Home Security

Enhancing the security of your home can significantly impact your insurance quotes. By installing security systems, alarms, deadbolts, and smoke detectors, you demonstrate to insurance companies that you are taking proactive measures to protect your home. This reduced risk of theft or damage can lead to lower insurance premiums.

Impact of Home Maintenance

Regular maintenance of your home, such as repairing roof leaks, updating electrical systems, and addressing plumbing issues, can also lower your insurance costs. Insurance companies view well-maintained homes as less risky, as they are less likely to experience sudden damages or accidents.

By keeping your home in good condition, you can potentially qualify for lower insurance rates.

Bundling Insurance Policies

Another effective strategy to reduce your homeowners insurance quotes is by bundling multiple insurance policies with the same provider. By combining your homeowners insurance with auto, life, or other types of insurance, you may be eligible for discounts or special offers.

This bundling approach not only simplifies your insurance management but can also result in cost savings across all your policies.

Understanding Coverage Options

When it comes to homeowners insurance, understanding the different coverage options available is crucial in making sure you have the right protection for your home. Each type of coverage offers a different level of protection and comes with its own benefits and costs.

By choosing the right coverage options, you can optimize your insurance quotes and ensure you are adequately covered in case of any unforeseen events.

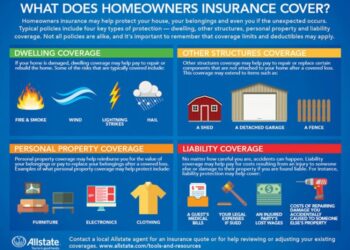

Types of Coverage

- 1. Dwelling Coverage: This type of coverage protects the structure of your home, including walls, roof, and foundation, in case of damage from covered perils such as fire, windstorms, or vandalism.

- 2. Personal Property Coverage: This coverage protects your personal belongings inside your home, such as furniture, electronics, and clothing, in case of theft or damage.

- 3. Liability Coverage: Liability coverage protects you if someone is injured on your property and you are found legally responsible for their injuries or damages.

- 4. Additional Living Expenses Coverage: This coverage helps cover the costs of temporary living arrangements if your home is uninhabitable due to a covered loss.

Benefits and Costs

- Each type of coverage comes with its own benefits and costs. Dwelling coverage, for example, is essential for protecting the structure of your home, but it may come at a higher cost compared to personal property coverage.

- Liability coverage may have a lower cost but provides crucial protection in case of lawsuits resulting from injuries on your property.

- It's important to weigh the benefits of each type of coverage against the costs to determine the right balance for your insurance needs.

Choosing the Right Coverage

- Consider the value of your home and personal belongings to determine the appropriate coverage limits for dwelling and personal property coverage.

- Assess your risk factors to decide on the level of liability coverage you need to protect your assets in case of a lawsuit.

- Review your budget and balance the costs of different coverage options to optimize your insurance quotes without sacrificing essential protection.

Leveraging Discounts and Credits

When it comes to lowering your homeowners insurance premiums, taking advantage of discounts and credits offered by insurance companies can be a great way to save money. These discounts are typically based on various factors and behaviors that reduce the risk for the insurance company.

Common Discounts Offered

- Multi-policy discount: Insuring your home and car with the same insurance company can often lead to a discount on both policies.

- New home discount: If your home is relatively new, you may be eligible for a discount due to the lower likelihood of issues with newer homes.

- Security system discount: Installing a security system in your home can lower the risk of theft and may qualify you for a discount on your insurance.

Eligibility Criteria for Discounts

- Meeting specific criteria: Insurance companies may have certain requirements that you need to meet to qualify for a discount, such as having a certain type of security system or a newer home.

- Regularly reviewing policies: It's important to review your policy regularly to see if you qualify for any new discounts that may have become available.

Qualifying for Credits

- Claim-free credit: If you have not filed any claims within a specific period, you may be eligible for a claim-free credit that can lower your premiums.

- Renewal credit: Some insurance companies offer discounts to policyholders who renew their policies with them, rewarding customer loyalty.

The Role of Deductibles in Insurance Quotes

Insurance deductibles play a crucial role in determining the cost of your homeowners insurance premiums. Understanding how deductibles work and how they can impact your insurance costs is essential for managing your expenses effectively.

Impact of Deductibles on Premiums

- Insurance deductibles refer to the amount of money you agree to pay out of pocket before your insurance coverage kicks in.

- The higher your deductible, the lower your insurance premium is likely to be.

- Lower deductibles result in higher premiums since the insurance company will be paying a larger portion of the claim.

Adjusting Deductibles for Savings

- Consider raising your deductible to reduce your insurance premium. For example, increasing your deductible from $500 to $1,000 can lead to significant savings.

- Before adjusting your deductible, make sure you have enough savings set aside to cover the higher out-of-pocket costs in case of a claim.

- Find the right balance by choosing a deductible amount that you can comfortably afford in the event of a loss, while still benefiting from lower premiums.

Tips for Setting the Right Deductible Amount

- Assess your financial situation and determine how much you can afford to pay out of pocket in the event of a claim.

- Consider the likelihood of filing a claim based on your location and property type when selecting a deductible amount.

- Consult with your insurance agent to understand how different deductible levels can impact your premiums and coverage options.

Comparison Shopping for Insurance Quotes

When it comes to lowering your homeowners insurance costs, one effective strategy is to engage in comparison shopping for insurance quotes. By exploring different options from various insurers, you can potentially find better coverage at a more affordable price. Here are some tips on how to navigate this process effectively.

Importance of Comparing Quotes

Comparing quotes from different insurers is crucial to ensure that you are getting the best value for your money. Each insurance company has its own pricing structure and coverage options, so by exploring multiple quotes, you can identify the most competitive offer that meets your needs.

Tips for Effective Comparison

- Obtain quotes from at least three different insurers to have a range of options to compare.

- Review the coverage details carefully to ensure they align with your specific requirements.

- Consider factors such as deductibles, liability limits, and additional coverage options when comparing quotes.

- Look beyond the price and evaluate the reputation and customer service of the insurer.

Potential Savings and Switching Insurers

By comparing quotes, you may discover opportunities for significant cost savings. If you find a more attractive offer from a different insurer, you can consider switching policies to take advantage of better rates. Additionally, you may be able to renegotiate your current policy based on the information gathered during your comparison shopping process.

Final Wrap-Up

In conclusion, mastering the art of legally lowering your homeowners insurance quote can lead to significant savings over time. By implementing the strategies discussed, you can optimize your coverage while keeping your expenses in check.

Question Bank

What are some common factors that influence homeowners insurance quotes?

Factors such as location, home value, and claims history can significantly impact insurance quotes. By understanding these factors, homeowners can take steps to mitigate them and lower their premiums.

How can improving home security help in reducing insurance quotes?

Enhancing home security with features like alarm systems and deadbolts can lower the risk of burglaries or damage, leading to potential discounts on insurance quotes.

What role do deductibles play in insurance quotes?

Deductibles are the amount policyholders pay out of pocket before insurance coverage kicks in. Adjusting deductibles can impact premiums, with higher deductibles usually resulting in lower insurance costs.