Embark on a journey to discover the secrets of securing the best homeowners insurance quote in 2025. From understanding coverage options to leveraging technology, this guide will equip you with the knowledge needed to make informed decisions.

Exploring the top insurance providers, coverage types, and key factors influencing quotes, this guide delves deep into the world of homeowners insurance, ensuring you are well-prepared for the future.

Researching Insurance Providers

When looking for the best homeowners insurance quote in 2025, it is essential to research insurance providers thoroughly to ensure you are getting the right coverage at a competitive price. Here are some key factors to consider when researching insurance providers:

Identify the Top Insurance Providers in 2025

- State Farm: Known for its excellent customer service and a wide range of coverage options.

- Allstate: Offers customizable policies and a user-friendly online platform for managing policies.

- USAA: Provides insurance exclusively to military members and their families with competitive rates.

- Progressive: Offers a variety of discounts and innovative tools for policy management.

Compare Coverage Options Offered by Different Providers

- Consider the types of coverage each provider offers, such as dwelling coverage, personal property coverage, liability coverage, and additional living expenses coverage.

- Look at the limits and deductibles available for each type of coverage to ensure they meet your needs.

- Compare any additional coverage options, such as flood insurance or identity theft protection, offered by different providers.

Discuss the Financial Stability and Customer Reviews of Potential Insurance Companies

- Check the financial stability of insurance providers by looking at their ratings from agencies like A.M. Best, Standard & Poor's, and Moody's.

- Read customer reviews and ratings on websites like J.D. Power and the Better Business Bureau to get an idea of the customer service experience provided by each insurance company.

- Consider reaching out to friends or family members who have experience with a particular insurance provider to get firsthand feedback on their experiences.

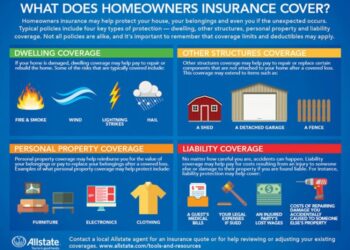

Understanding Homeowners Insurance Coverage

When it comes to homeowners insurance, understanding the different types of coverage available is crucial to ensuring you have the protection you need. Let's delve into the key aspects of homeowners insurance coverage.

Types of Coverage

- Dwelling Coverage: This covers the structure of your home in case of damage from covered perils such as fire, windstorms, or vandalism.

- Personal Property Coverage: This protects your belongings inside the home, including furniture, clothing, and electronics, in case of theft, damage, or destruction.

- Liability Coverage: This provides protection in case someone is injured on your property and decides to sue you for damages.

Importance of Liability Coverage

- Liability coverage is crucial as it protects you financially in case of a lawsuit resulting from injuries or damages that occur on your property.

- It can help cover legal fees, medical expenses, and settlement costs, providing you with peace of mind and financial security.

- Without liability coverage, you could be personally responsible for paying these costs out of pocket, which can be financially devastating.

Personal Property Coverage

- Personal property coverage ensures that your belongings are protected in case of theft, damage, or loss due to covered perils.

- It typically covers items such as furniture, clothing, appliances, and electronics, both inside and outside your home.

- It's essential to take inventory of your possessions and determine their value to ensure you have adequate personal property coverage.

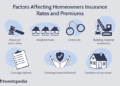

Factors Influencing Insurance Quotes

Location, age and condition of the home, and security systems are critical factors that influence homeowners insurance quotes.

Location Impact on Insurance Quotes

The location of your home plays a significant role in determining your insurance premium. Homes located in high-risk areas prone to natural disasters such as floods, hurricanes, or earthquakes typically have higher insurance costs. In contrast, homes in low-crime neighborhoods or areas with good access to emergency services may receive lower insurance quotes.

Age and Condition of the Home

The age and condition of your home directly impact insurance costs. Older homes or properties in poor condition may be at higher risk for damage or maintenance issues, leading to increased premiums. On the other hand, newer homes or well-maintained properties may qualify for lower insurance rates due to their reduced risk of claims.

Impact of Security Systems and Fire Alarms

Installing security systems, fire alarms, or other safety features in your home can help lower insurance quotes. These measures reduce the risk of theft, vandalism, or fire damage, making your property less risky to insure. Insurance providers often offer discounts for homes with security systems or fire alarms, as they decrease the likelihood of costly claims.

Utilizing Technology to Get Quotes

In today's digital age, technology has revolutionized the way we obtain homeowners insurance quotes. With the use of advanced tools and platforms, the process has become more efficient and convenient for homeowners looking to protect their properties.AI and data analytics play a crucial role in determining insurance premiums by analyzing various factors such as the location of the property, its age, and the homeowner's claims history.

By utilizing these technologies, insurance companies can provide more accurate quotes based on specific risk assessments, ultimately ensuring fair pricing for policyholders.

Benefits of Using Online Platforms to Compare Quotes

Online platforms offer homeowners the convenience of comparing quotes from different insurance providers in a matter of minutes. This allows them to easily evaluate various coverage options, pricing, and customer reviews all in one place, without the need to contact multiple agents individually.

- Save Time: By using online platforms, homeowners can quickly compare quotes from multiple providers without the hassle of making numerous phone calls or appointments.

- Transparency: Online platforms provide transparent information on coverage options, premiums, and deductibles, allowing homeowners to make informed decisions.

- Cost Savings: By comparing quotes online, homeowners can potentially find more affordable insurance options that meet their needs and budget.

- Easy Access: Online platforms are accessible 24/7, allowing homeowners to research and obtain quotes at their convenience, anytime and anywhere.

Last Word

As we conclude this discussion on getting the best homeowners insurance quote in 2025, remember that being informed is the key to making the right choices. By utilizing the insights shared in this guide, you can navigate the insurance landscape with confidence and peace of mind.

General Inquiries

How does the location impact homeowners insurance quotes?

The location of your home plays a significant role in determining insurance quotes. Areas prone to natural disasters or high crime rates may result in higher premiums.

What is the importance of liability coverage in homeowners insurance?

Liability coverage protects you in case someone is injured on your property. It helps cover legal expenses and medical bills if you're found responsible.

How can technology streamline the process of obtaining insurance quotes?

Technology allows for quick and easy comparison of quotes from different providers online, saving you time and effort in the insurance shopping process.