Exploring the impact of home renovations on homeowners insurance quotes opens up a world of possibilities. From enhancing the value of your home to potentially lowering insurance premiums, the journey of understanding this relationship is both enlightening and essential for homeowners.

As we delve deeper into the types of renovations that can affect insurance quotes and the importance of informing insurance companies about these changes, a clearer picture emerges of how homeowners can navigate the complexities of insurance in the face of renovations.

Ways Home Renovations Impact Homeowners Insurance

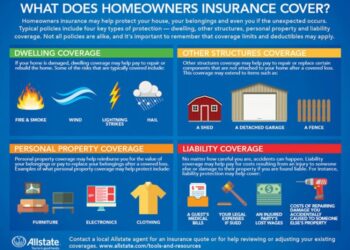

When it comes to home renovations, the changes you make to your property can have a significant impact on your homeowners insurance. These changes can affect the value of your home, the risk factors associated with it, and ultimately, the cost of your insurance premiums.

Let's explore how renovations can impact your homeowners insurance.

Renovations Affecting Home Value

Renovations can increase the value of your home, which in turn may affect the amount of coverage you need. For example, adding a new room, updating the kitchen, or upgrading the bathroom can all contribute to raising the value of your property.

As a result, you may need to adjust your coverage limits to ensure that your home is adequately protected in case of damage or loss.

Adding Features to Lower Premiums

On the other hand, certain renovations can actually help lower your insurance premiums. Installing features like a new roof, impact-resistant windows, or a security system can reduce the risk of damage or theft, making your home less of a liability for insurance companies.

As a result, you may qualify for discounts on your premiums, saving you money in the long run.

Impact on Replacement Cost

Renovations that increase the replacement cost of your home can also impact your coverage limits. If you've made significant improvements that would cost more to rebuild in case of a total loss, you may need to adjust your coverage to reflect these changes.

Failing to update your policy to cover the increased replacement cost could leave you underinsured in the event of a disaster.

Types of Renovations that Affect Insurance Quotes

When it comes to home renovations, certain upgrades can have a direct impact on your homeowners insurance quotes. These renovations can either increase home safety and reduce insurance risks, or they can potentially raise insurance costs due to added liabilities.

Renovations that Increase Home Safety and Reduce Insurance Risks

- Installing a home security system: Adding a security system can deter burglaries and intruders, reducing the risk of theft and vandalism.

- Upgrading electrical and plumbing systems: Updating old electrical wiring or plumbing can prevent potential hazards like fires or water damage, leading to lower insurance premiums.

- Roof replacement: A new roof can protect your home from weather-related damage, decreasing the likelihood of claims and lowering insurance costs.

Renovations that Can Raise Insurance Costs

- Adding a swimming pool: While a pool can be a great addition to your home, it also poses a higher risk of accidents or injuries, resulting in increased liability coverage and higher insurance premiums.

- Installing a fireplace: Fireplaces can elevate the risk of fires and carbon monoxide poisoning, leading to higher insurance rates to cover these potential hazards.

- Building an extension: Expanding your home can increase its overall value, which may require additional coverage to protect the added square footage, resulting in higher insurance costs.

Importance of Informing Insurance Companies About Renovations

Updating your insurance provider after making renovations is crucial to ensure that your homeowners insurance policy remains accurate and up-to-date. Failing to disclose renovations can result in coverage gaps or claim denials, leaving you financially vulnerable in the event of a loss.

It is essential to inform your insurance company about any changes to your home to avoid potential complications.

Process of Informing Your Insurance Company About Home Improvements

- Review your current homeowners insurance policy to understand what is covered and what renovations may impact your coverage.

- Contact your insurance agent or provider to inform them about the renovations you have made or are planning to make.

- Provide detailed information about the renovations, including the type of improvements, materials used, and the cost of the renovations.

- Your insurance provider may require an inspection of the renovated areas to assess the impact on your policy.

- After informing your insurance company, make sure to review any changes to your policy and coverage to ensure that you are adequately protected.

Tips for Managing Homeowners Insurance Costs after Renovations

![[EXPLAINED] Renovations and Home Insurance | TGS Insurance [EXPLAINED] Renovations and Home Insurance | TGS Insurance](https://exterior.acehsiana.com/wp-content/uploads/2025/11/renovations-affect-home-insurance-1.png)

When it comes to managing homeowners insurance costs after renovations, there are several strategies that homeowners can implement to potentially reduce their insurance premiums and ensure they have adequate coverage. Additionally, insurance agents play a crucial role in assisting homeowners in navigating any changes in coverage resulting from renovations.

Review and Update Coverage Limits

After completing renovations, it is essential for homeowners to review and update their coverage limits to ensure they adequately protect the increased value of their home and any new additions. This may involve increasing the dwelling coverage or adding endorsements for specific renovations.

Consider Increasing Deductibles

One way to potentially lower insurance premiums post-renovation is by increasing deductibles. By opting for a higher deductible, homeowners can reduce their monthly premiums. However, it is important to ensure that the deductible amount is still affordable in the event of a claim.

Bundle Insurance Policies

Another strategy to manage homeowners insurance costs is to bundle insurance policies with the same provider. Many insurance companies offer discounts to customers who purchase multiple policies, such as home and auto insurance, from them.

Implement Safety and Security Measures

Installing safety and security measures, such as smoke detectors, alarm systems, and deadbolt locks, can not only enhance the safety of the home but also lead to potential discounts on homeowners insurance premiums. Homeowners should inquire with their insurance provider about available discounts for such measures.

Regularly Review and Compare Policies

It is advisable for homeowners to regularly review and compare insurance policies to ensure they are getting the best coverage at the most competitive rates. This can involve obtaining quotes from different insurance companies and assessing the coverage options they offer.

Last Word

In conclusion, the dynamic interplay between home renovations and homeowners insurance quotes underscores the need for vigilance and proactive communication with insurance providers. By following the tips for managing insurance costs post-renovation, homeowners can ensure they are adequately covered and prepared for any changes that may arise.

FAQ Corner

How do renovations affect the value of my home?

Renovations can increase the value of your home, potentially impacting your insurance coverage and premiums.

Why is it important to inform insurance companies about renovations?

Informing insurance companies about renovations ensures that your coverage accurately reflects the changes in your home, avoiding any potential coverage gaps or claim denials.

What are some common renovations that can impact homeowners insurance?

Renovations like adding a new roof, security system, or swimming pool can all impact your homeowners insurance.