Homeowners Insurance Quote for First-Time Buyers: Complete Guide sets the stage for this informative exploration, providing a comprehensive look into the world of homeowners insurance for those stepping into the real estate market for the first time.

The following paragraphs delve into key aspects of homeowners insurance, shedding light on important considerations and tips for new buyers.

Understanding Homeowners Insurance for First-Time Buyers

Homeowners insurance is a crucial safeguard for first-time buyers, providing protection for your most valuable asset - your home. It offers financial security in the event of unforeseen circumstances such as natural disasters, theft, or accidents.

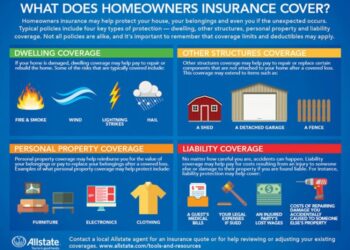

Key Components of a Typical Homeowners Insurance Policy

- Property Coverage: This includes coverage for the physical structure of your home, as well as other structures on your property such as a garage or shed.

- Liability Coverage: Protects you in case someone is injured on your property and you are found responsible.

- Personal Property Coverage: Covers the belongings inside your home, such as furniture, electronics, and clothing.

- Additional Living Expenses: Provides coverage for temporary living arrangements if your home becomes uninhabitable due to a covered event.

Difference Between Actual Cash Value and Replacement Cost Coverage

When it comes to homeowners insurance, it's important to understand the difference between actual cash value (ACV) and replacement cost coverage.

- Actual Cash Value (ACV):This type of coverage takes depreciation into account when reimbursing you for a covered loss. This means you may receive less than the original value of the item.

- Replacement Cost Coverage:With this type of coverage, the insurance company will pay the full cost to replace the item without deducting for depreciation. This provides more comprehensive coverage but may come with a higher premium.

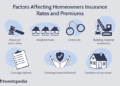

Factors Affecting Homeowners Insurance Quotes

When it comes to getting a homeowners insurance quote, there are several factors that can impact the cost. Understanding these factors can help first-time buyers make informed decisions and potentially save money on their insurance premiums.

Location Impact on Homeowners Insurance Quotes

The location of your home plays a significant role in determining your homeowners insurance premium. Homes located in areas prone to natural disasters such as hurricanes, earthquakes, or wildfires may have higher insurance costs due to the increased risk of damage.

Additionally, homes in high-crime areas may also face higher insurance premiums. On the other hand, homes in safe neighborhoods with low crime rates and minimal risk of natural disasters may have lower insurance costs.

Age and Condition of Home Influence on Insurance Costs

The age and condition of your home can also affect your homeowners insurance quote. Older homes or homes in poor condition may be more prone to structural damage or issues with plumbing, electrical systems, or roofing. As a result, insurance companies may charge higher premiums to cover the increased risk of potential claims.

It's important to properly maintain your home to ensure that it meets insurance standards and potentially lower your insurance costs.

Impact of Chosen Coverage Limits and Deductible

The coverage limits and deductible you choose for your homeowners insurance policy can directly impact the cost of your insurance quote. Higher coverage limits or lower deductibles typically result in higher premiums, as the insurance company would need to pay out more in the event of a claim.

On the other hand, opting for lower coverage limits or higher deductibles can help lower your insurance costs, but it's important to ensure that you have adequate coverage to protect your home and belongings in case of an unexpected event.

Tips for First-Time Buyers to Get Accurate Quotes

When it comes to obtaining homeowners insurance quotes as a first-time buyer, there are a few key tips to keep in mind. By being prepared and knowing what information is needed, you can ensure that you receive accurate quotes that reflect your specific needs and circumstances.

Checklist of Information Needed

Before reaching out to insurance providers for quotes, make sure you have the following information on hand:

- Details about your home's construction and materials

- Information about the neighborhood and proximity to fire hydrants or fire stations

- The value of your personal belongings and any high-value items

- Your desired coverage limits and deductible amount

- Details about any recent renovations or upgrades to your home

Strategies to Lower Insurance Premiums

To lower insurance premiums as a first-time homebuyer, consider the following strategies:

- Bundle your homeowners insurance with other policies, such as auto insurance

- Improve home security with alarms, deadbolts, or a security system

- Opt for a higher deductible to lower monthly premiums

- Maintain a good credit score, as this can impact your insurance rates

- Inquire about discounts for factors like being a non-smoker or having a new home

Importance of Comparing Quotes

Comparing quotes from multiple insurance providers is crucial for first-time buyers because it allows you to:

- Understand the range of coverage options available to you

- Identify any gaps in coverage or areas where you may be overpaying

- Find the best value for your specific needs and budget

- Ensure you are getting the most competitive rates in the market

Common Mistakes to Avoid When Getting Quotes

When first-time buyers are looking to get homeowners insurance quotes, there are some common mistakes that can easily be made. These mistakes can lead to potential issues in the future if not addressed properly. It is important to be aware of these pitfalls to ensure you get the right coverage for your home.

Underinsuring a Home

One common mistake that first-time buyers make when getting homeowners insurance quotes is underinsuring their home. This means not getting enough coverage to fully protect their property in the event of a disaster. Underinsuring can leave you financially vulnerable and unable to fully recover from a loss.

It is crucial to accurately assess the value of your home and its contents to determine the appropriate coverage needed. Working with an experienced insurance agent can help you understand the true replacement cost of your home and avoid the mistake of underinsuring.

Understanding Policy Exclusions and Limitations

Another common mistake is not fully understanding the policy exclusions and limitations. Every homeowners insurance policy comes with certain exclusions and limitations that Artikel what is not covered by the policy. Failing to understand these can lead to surprises when you need to file a claim.

It is essential to carefully review the policy documents and ask your insurance agent about any areas that are unclear. Being aware of what is not covered can help you make informed decisions about additional coverage options or risk mitigation strategies.

Closure

In conclusion, this guide has equipped first-time buyers with valuable insights and practical advice to navigate the realm of homeowners insurance with confidence. Armed with this knowledge, new homeowners can make informed decisions and secure their investment effectively.

Question & Answer Hub

What factors can impact homeowners insurance quotes?

Factors such as location, home age, and coverage limits can influence insurance costs.

How can first-time buyers lower insurance premiums?

First-time buyers can lower premiums by comparing quotes, increasing home security measures, and maintaining a good credit score.

What are common mistakes to avoid when getting homeowners insurance quotes?

Common mistakes include underinsuring a home, not understanding policy exclusions, and failing to compare quotes from different providers.