Kicking off with Homeowners Insurance Quote Explained: What You’re Really Paying For, this opening paragraph is designed to captivate and engage the readers, providing a detailed insight into the world of homeowners insurance quotes.

Exploring the components, factors, and coverage types involved in homeowners insurance quotes, this article aims to shed light on what homeowners are truly paying for.

Understanding Homeowners Insurance Quote

When getting a homeowners insurance quote, it's essential to understand what you're paying for and how different factors can influence the cost. Let's break down the components typically included in a homeowners insurance quote and explore the factors that can impact the price.

Components of a Homeowners Insurance Quote

- Property Coverage: This includes coverage for your home structure and any attached buildings, such as a garage or deck.

- Personal Property Coverage: Protects your belongings inside the home, like furniture, electronics, and clothing.

- Liability Coverage: Covers legal expenses if someone is injured on your property and you are found liable.

- Add-Ons or Endorsements: Additional coverage for specific risks, such as flood insurance or identity theft protection.

Factors Influencing Homeowners Insurance Quote

- Location: Proximity to natural disaster-prone areas or crime rates in the neighborhood can impact the cost.

- Home Characteristics: Age, size, construction materials, and condition of the home can affect the quote.

- Claims History: Past insurance claims on the property can signal higher risk and lead to increased premiums.

- Credit Score: A good credit score can result in lower insurance rates, as it is often correlated with responsible behavior.

Impact of Coverage Limits and Deductibles

- Coverage Limits: Higher coverage limits mean more protection but also higher premiums. Adjusting these limits can impact the overall cost of the quote.

- Deductibles: Choosing a higher deductible can lower your premium, but it means you'll pay more out of pocket in the event of a claim.

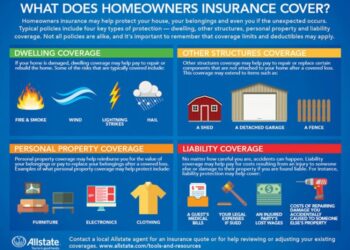

Coverage Types in Homeowners Insurance

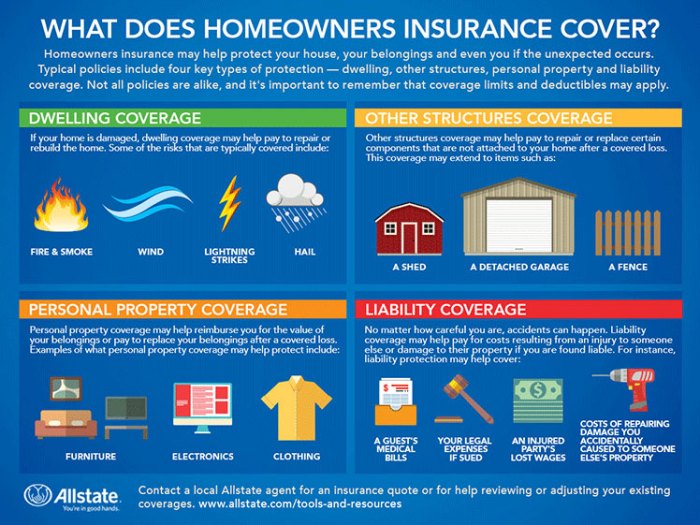

When it comes to homeowners insurance, there are several types of coverage included in a standard policy that provide financial protection for your home and belongings. Understanding these coverage types is essential to ensure you have adequate protection in case of unexpected events.Homeowners insurance typically includes the following types of coverage:

Dwelling Coverage

Dwelling coverage protects the structure of your home, including the walls, roof, foundation, and other attached structures. In the event of damage from covered perils such as fire, windstorm, or vandalism, dwelling coverage helps pay for repairs or rebuilding your home.

Personal Property Coverage

Personal property coverage helps replace or repair your personal belongings inside your home, such as furniture, clothing, electronics, and appliances, if they are damaged or stolen. This coverage extends to items both inside and outside your home.

Liability Coverage

Liability coverage protects you financially if someone is injured on your property or if you accidentally damage someone else's property. This coverage can help pay for legal expenses, medical bills, and damages if you are found liable for an accident.

Additional Living Expenses Coverage

Additional living expenses coverage, also known as loss of use coverage, provides reimbursement for temporary living expenses if your home becomes uninhabitable due to a covered loss. This can include hotel bills, restaurant meals, and other necessary expenses while your home is being repaired.

Optional Coverages

In addition to the basic coverage types, homeowners can also add optional coverages to their insurance policy to enhance their protection. Examples of optional coverages include:

Flood insurance

Provides coverage for damage caused by floods, which is not typically covered by standard homeowners insurance.

Earthquake insurance

Protects your home and belongings from damage caused by earthquakes, which are also not covered by standard policies.

Scheduled personal property coverage

Allows you to insure high-value items such as jewelry, art, or collectibles for their full value.Adding optional coverages to your homeowners insurance policy can increase your premium, but it can also provide valuable protection for specific risks that may not be covered by standard policies.

Factors Affecting Homeowners Insurance Premiums

When it comes to determining homeowners insurance premiums, several factors come into play that can influence the cost you pay for coverage

Location of Home

The location of your home plays a significant role in determining your insurance premiums. Homes located in areas prone to natural disasters such as hurricanes, earthquakes, or wildfires typically have higher insurance costs. Additionally, proximity to a fire station, crime rates in the neighborhood, and the likelihood of flooding can all impact the price of your insurance policy.

Home's Age, Condition, and Construction Materials

The age, condition, and construction materials of your home are also important factors that insurance companies consider when calculating premiums. Older homes may have outdated electrical systems, plumbing, or roofing, which can increase the risk of damage and lead to higher premiums.

Homes constructed with fire-resistant materials may be eligible for discounts, while those with high-risk materials like wood shingles may face higher costs.

Homeowner's Claims History

Your claims history as a homeowner can also affect the price of your insurance quotes. If you have a record of filing multiple claims for previous damages or losses, insurance companies may see you as a higher risk and charge you more for coverage.

Conversely, homeowners with a clean claims history may be eligible for discounts and lower premiums.

Discounts and Savings Opportunities

When it comes to homeowners insurance, there are various discounts and savings opportunities that homeowners can take advantage of to reduce their premiums and save money in the long run.

Common Discounts for Homeowners Insurance

- Multi-policy discount: By bundling your home and auto insurance policies with the same provider, you can often receive a discount on both policies.

- Home security systems: Installing a monitored home security system can help reduce the risk of theft or damage, leading to lower insurance premiums.

- New home discount: If your home is newly built or recently renovated, you may qualify for a discount on your insurance premium.

- Claims-free discount: Homeowners who have not filed any insurance claims in a certain period may be eligible for a claims-free discount.

Bundling Home and Auto Insurance

- By combining your home and auto insurance policies with the same provider, you can often receive a significant discount on both policies.

- Insurance companies offer this discount as an incentive to keep all your insurance needs with them, making it a convenient and cost-effective option for many homeowners.

Proactive Measures to Reduce Premiums

- Increasing your deductible: Opting for a higher deductible can lower your insurance premium, but make sure you have enough savings to cover the deductible in case of a claim.

- Maintaining a good credit score: Insurance companies often use credit scores to determine premiums, so maintaining a good credit score can help lower your insurance costs.

- Regularly reviewing your policy: Make sure your coverage limits and deductibles are still appropriate for your needs, and adjust them as necessary to avoid overpaying for coverage you don't need.

- Home improvements: Upgrading your home's roof, plumbing, or electrical systems can reduce the risk of damage and may qualify you for discounts on your insurance premium.

Last Word

Wrapping up the discussion on Homeowners Insurance Quote Explained: What You’re Really Paying For, it's clear that understanding the intricacies of insurance quotes is crucial for homeowners to make informed decisions about their coverage.

Essential FAQs

What factors can influence the cost of a homeowners insurance quote?

Factors such as the location of the home, coverage limits, deductibles, and the homeowner's claims history can all impact the cost of a homeowners insurance quote.

What are some common discounts homeowners can qualify for?

Common discounts include multi-policy discounts, home security discounts, and loyalty discounts for long-term customers.

How do optional coverages affect the price of a homeowners insurance quote?

Optional coverages can increase the price of a homeowners insurance quote, but they provide additional protection and coverage for specific risks not covered by standard policies.

Why is it important to consider a home's construction materials when determining insurance costs?

The construction materials can impact the home's vulnerability to certain risks like fire or storms, which in turn affects the insurance premiums.