Comparing Homeowners Insurance Quotes: Top 5 Companies Ranked sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality.

As we delve into the world of homeowners insurance, exploring the top companies and their offerings, a wealth of valuable information awaits those seeking the best coverage for their homes.

Research Methodology

When comparing homeowners insurance quotes, it is essential to follow a structured methodology to ensure you make an informed decision. Here are the key steps to effectively compare quotes and rank insurance companies:

Key Factors to Consider

- Coverage Options: Evaluate the types of coverage offered by each insurance company and determine if they align with your needs. Look for comprehensive coverage that includes protection for your home, personal belongings, and liability.

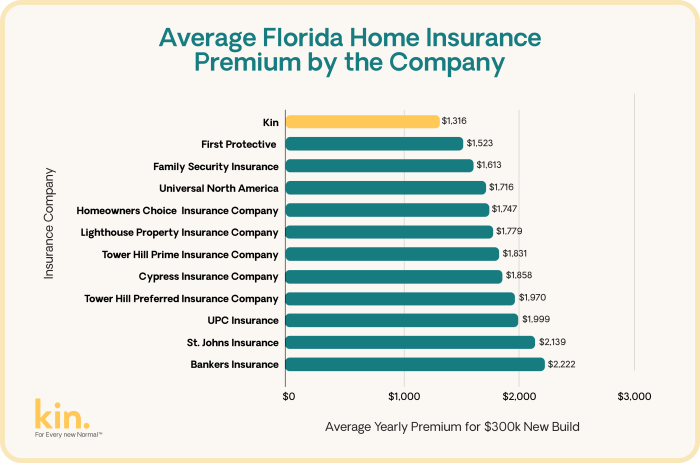

- Premium Costs: Compare the premium costs for similar coverage levels across different insurance companies. It's important to strike a balance between affordability and adequate coverage.

- Deductibles: Consider the deductibles associated with each policy. A higher deductible can lower your premium but may require you to pay more out of pocket in the event of a claim.

- Customer Service: Research the reputation of each insurance company for customer service and claims handling. Reading reviews and testimonials can provide valuable insights into the customer experience.

- Financial Strength: Verify the financial stability of the insurance companies you are considering. A financially strong company is more likely to fulfill its obligations in case of a claim.

Importance of Reading Reviews

Reading reviews and testimonials from current and past customers can give you a better understanding of the insurance company's reputation and customer satisfaction levels. Pay attention to feedback regarding claims processing, customer service, and overall experience. This information can help you make an informed decision when selecting a homeowners insurance provider.

Company #1

Company #1, founded in [year], has established itself as a reputable provider of homeowners insurance with a strong track record of customer satisfaction. They offer a wide range of coverage options to meet the diverse needs of homeowners.

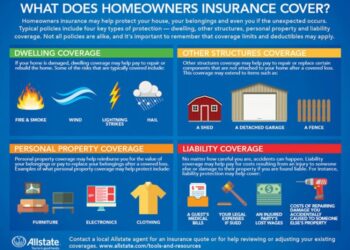

Types of Homeowners Insurance Coverage

- Basic Dwelling Coverage: Provides protection for the structure of your home in the event of covered perils such as fire, vandalism, or wind damage.

- Personal Property Coverage: Helps replace or repair personal belongings like furniture, electronics, and clothing that are damaged or stolen.

- Liability Coverage: Offers financial protection in case someone is injured on your property and you are found liable for their injuries.

- Add-On Options: Additional coverage options may include flood insurance, earthquake insurance, or identity theft protection.

Pricing Options and Discounts

- Competitive Rates: Company #1 offers competitive rates for homeowners insurance, making it an affordable option for many homeowners.

- Discounts: They provide various discounts such as multi-policy discounts, new home discounts, and claims-free discounts to help policyholders save on their premiums.

- Bundling Options: Customers may also have the option to bundle their homeowners insurance with other policies, such as auto insurance, for additional savings.

Company #2: Overview

Company #2 is a well-established insurance provider known for its comprehensive coverage options and competitive rates. They have been serving homeowners for many years, building a solid reputation for reliability and customer satisfaction.

Customer Service Reputation

Company #2 is highly regarded for their exceptional customer service. They have a dedicated team of representatives who are available to assist policyholders with any questions or concerns they may have. Customers often praise the company for their responsiveness and helpfulness in resolving issues.

Unique Features and Benefits

- Discounts for bundling home and auto insurance policies

- Flexible coverage options to tailor policies to individual needs

- 24/7 claims support for quick and efficient claims processing

- Online policy management tools for easy access to account information

- Renewal discounts for loyal customers

Company #3: Overview

Company #3 is a well-established insurance provider known for its comprehensive coverage options and competitive rates. They have a strong reputation for excellent customer service and prompt claims processing.

Claims Process Efficiency

- Company #3 boasts a streamlined claims process that aims to make it easy for policyholders to file and track claims online.

- Their dedicated claims team works efficiently to assess claims quickly and provide timely resolutions to customers.

- Policyholders have reported high satisfaction with the speed and transparency of the claims process offered by Company #3.

Financial Strength and Stability

- Company #3 has a solid financial standing, backed by strong reserves and a history of consistent profitability.

- They have received high ratings from independent rating agencies, indicating their financial stability and ability to meet policyholder obligations.

- This financial strength ensures that customers can rely on Company #3 to fulfill their insurance commitments, even in times of economic uncertainty.

Company #4: Overview

Company #4 is a well-established insurance provider known for its comprehensive coverage options and competitive rates. They offer a wide range of additional coverage options to customize policies based on individual needs and preferences.

Additional Coverage Options

- Personal Property Coverage: This option provides protection for personal belongings such as jewelry, electronics, and furniture.

- Liability Coverage: Protects policyholders in case someone is injured on their property and files a lawsuit.

- Flood Insurance: Offers coverage for damages caused by floods, which are not typically covered in standard homeowners insurance policies.

Online Tools and Resources

Company #4 provides policyholders with user-friendly online tools and resources to manage their policies effectively. These tools include:

- Online Claims Filing: Policyholders can easily file claims online, streamlining the process and expediting claim resolution.

- Policy Management Portal: Allows customers to access their policy details, make payments, and update information online.

- Resource Center: Offers valuable information on home maintenance, safety tips, and insurance FAQs to help policyholders make informed decisions.

Company #5: Overview

Company #5 is a well-established insurance provider with a strong reputation in the industry. They have been serving homeowners for many years, offering a wide range of coverage options to meet various needs.One specific criterion in which Company #5 excels compared to competitors is their competitive pricing.

They offer affordable premiums without compromising on the quality of coverage provided. This makes them a popular choice among budget-conscious homeowners looking for reliable insurance.In terms of responsiveness, Company #5 has a dedicated customer service team that is known for handling inquiries and complaints promptly and efficiently.

They strive to provide excellent support to their policyholders, ensuring that any issues or concerns are addressed in a timely manner. This commitment to customer satisfaction sets them apart from other insurance companies in the market.

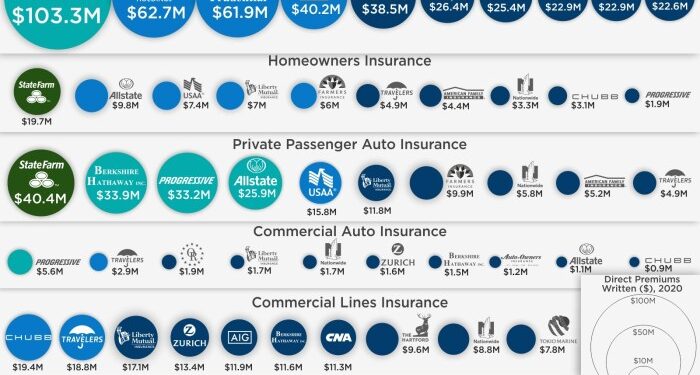

Comparative Analysis

When comparing homeowners insurance quotes, it is essential to consider the coverage options and average premium costs offered by different companies. This analysis will help homeowners determine which company might be the best fit for their specific needs and preferences.

Coverage Options Comparison

| Company | Basic Coverage | Additional Coverage Options |

|---|---|---|

| Company #1 | Standard coverage for dwelling and personal property | Options for water damage and personal liability |

| Company #2 | Basic coverage with replacement cost coverage | Extended coverage for valuable items and identity theft protection |

| Company #3 | Standard coverage with optional earthquake insurance | Additional coverage for home business and pet liability |

| Company #4 | Basic coverage with guaranteed replacement cost | Options for equipment breakdown and service line coverage |

| Company #5 | Standard coverage with green rebuilding options | Additional coverage for landscaping and outdoor structures |

Average Premium Costs Comparison

- Company #1: The average premium cost for basic coverage is competitive, but additional coverage options can increase the overall cost.

- Company #2: Offers comprehensive coverage with slightly higher average premium costs compared to other companies.

- Company #3: Affordable premium costs with the option to add specialized coverage for specific needs.

- Company #4: Premium costs are slightly higher due to guaranteed replacement cost and additional coverage options.

- Company #5: Competitive premium costs with unique coverage options for eco-friendly rebuilding.

Best Fit for Specific Homeowner Needs

Based on the analysis, Company #3 might be the best fit for homeowners looking for affordable coverage with the flexibility to add specialized options for their specific needs. However, homeowners with a preference for green rebuilding options might find Company #5 more suitable.

Final Conclusion

In conclusion, the journey through Comparing Homeowners Insurance Quotes: Top 5 Companies Ranked unveils a tapestry of options and considerations, guiding homeowners towards making informed decisions about protecting their most valuable asset.

Top FAQs

What factors should I consider when comparing homeowners insurance quotes?

When comparing quotes, consider coverage limits, deductibles, additional coverage options, discounts, and the reputation of the insurance company.

How can I determine which company is the best fit for my homeowner needs?

To find the best fit, assess coverage options, pricing, customer service reputation, and any unique features each company offers. Consider what matters most to you in a policy.

Is reading reviews and testimonials important before choosing an insurance company?

Yes, reading reviews and testimonials can provide insight into the experiences of other policyholders, helping you gauge the reliability and quality of service offered by the insurance company.